Beyond Succession: Family Firms Need a Legacy Plan Too

Succession planning has been a heavily researched topic and buzzword for many years now. However, its lesser-known counterpart -- legacy planning – is becoming a part of many families' personal estate planning, and now we are seeing a shift to include it in the family business realm as well.

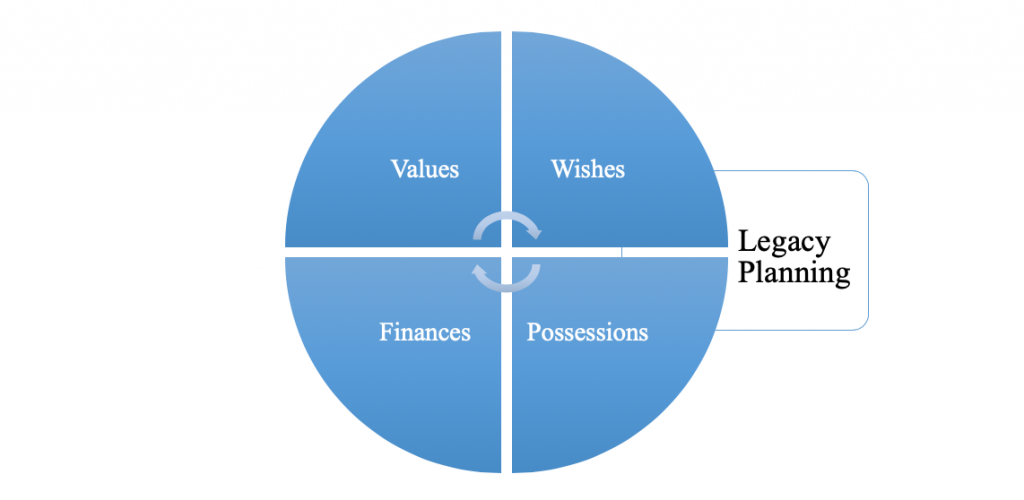

In simple terms, legacy planning means formalizing a business family’s interests, values, wishes and traditions to promote not only continued financial health, but also meaningful principles to guide the family and the business. Below is a simple diagram displaying legacy planning and its interconnected variables:

Along with a healthy business, families want to leave something of significant but less tangible value for future generations, whether that’s an innovative spirit, a commitment to the community or something else. Therefore, families must ensure that the next generation understands and appreciates its core beliefs, especially when it aligns well with the succession plan. This article addresses some key considerations of legacy planning for family businesses as they work to navigate these relatively difficult topics.

It is a ‘Must-Do’, Not a ‘Will-Do’

It is no surprise that businesses that thrive take succession planning more seriously than those that fail. Sharma et al.’s (2003) conceptual model contemplates whether the propensity for the incumbent to step aside has a direct effect on the successor’s satisfaction with the succession planning process. The succession planning process involves investing, grooming, setting a plan, following through and then allowing the successor to lead in a way to ensure the perpetuity of a business. It is the actual mechanics of the business—asking and answering the questions: Who will do what when I pass away? And how? Who has the skills to succeed me? Who has the potential?

However, the core beliefs, values and narratives that will carry a family business are discussed less often. A family business should take the additional step to create a legacy plan to safeguard not only the continuity of the business but also the family. Some family businesses think about legacy only when they are in mourning or in crisis after the business leader dies. It’s far better to be proactive and craft a concrete values-based foundation while the leader is still alive: one that will inform how the business operates going forward and into the next generation of leadership.

Being proactive means assessing what has been built and fine-tuning it for the future. While some see legacy planning as no different from estate planning, it’s actually a more holistic approach that ensures all business decisions have a common ethos that is maintained for generations, for the benefit of both the family and the business.

Value System Conveyed

Most businesses have a mission statement that provides a foundation to guide the business. Research suggests that some family businesses initially draft a mission statement but often can’t implement it because it’s unclear.

To make things worse, the basic core beliefs of a business are often not written down or communicated very well; most assume the beliefs are just inherent and understood. Moreover, many founders of profitable family businesses have never shared what has driven them to work so hard, what is important to them or what they would love to see carried on through the business after they’re gone. But without true identifiable core beliefs that create a systematic value system, a business “identity crisis” can arise during a transition in leadership. Communicating these personal values can be difficult and fraught with emotion, but it must be done because it can make an impact on the business’s resilience and future success. These statements sum up what such values might be:

· Our family prides itself on honesty and loyalty while providing services to our partners.

· We, the Smith Family, strive to promote authenticity in the organic products we produce.

· Our legacy is deeply rooted in tradition, integrity and charitable giving in our community.

Second, trust plays a role in acceptance and longevity of core family values as well. Wang (2019) states the role of relationship-based patriarchal trust prevails in the initial phase of starting a business; whereas, institution-based trust is required for the sustainability of a business. Without true company values, this sustainability is at risk.

Not only does trust play a role here; but according to Prince (2016), business productivity also aligns well with strong family values. These values not only define what’s important to the family, but also help the business establish a long-term orientation. A good legacy plan is valuable because it ensures that these core values translate well to successors and employees as well as the customer base, yielding positive results.

Have the Conversation

When crafting a legacy plan for the future, family business members must do research, think about what’s important to them, discuss their priorities and make decisions that will satisfy both the current owners and future generations. Everyone’s desires and priorities should be well communicated and respectfully considered. Conversation regarding succession and legacy often bring a sense of “doom and gloom” but it does not have to be that way. Being honest and upfront about wishes and priorities helps minimize hurt feelings and broken relationships down the road. Research shows that a strong family connection is the key fuel for success when changes occur.

Write it Down

After the conversation has occurred, it is imperative to document the discussions and final decisions, through family board meeting minutes, a video recording or general notetaking. Families should use both organizational incorporation documents and estate planning tools to formalize the legacy plan. A last will and testament, with an attached memorandum referenced in the will, can also codify the final decisions as to one’s business interest. The use of a licensed attorney specializing in wills, trusts and estates is vital here.

It is crucial for families to recognize that a standard legacy plan -- with boilerplate language that serves every family regardless of size, industry and values -- does not exist. Every legacy plan is customized according to the family’s individual circumstances. Ultimately, documenting discussions and decisions is a good practice for any business, because a formal written plan will provide clarity if legal issues arise in the future.

Live your Narrative and Values

Lastly, once formalized, the family’s narrative and values must inform everything it does, from outside marketing to internal company emails. Consistency in messaging and action will help sustain employee identity, reinforce brand loyalty with customers, and help other stakeholders see the company in a positive light. Consider incorporating the company values into how you treat employees, and in communications with vendors, customers, community leaders and other stakeholders.

In sum, avoid putting legacy planning on a to-do list that never gets done; do it now. Think about what matters most, then have the conversation in a collaborative spirit. Decide on the narrative that best captures your family legacy, fine-tune it, formalize it and let it permeate everything you do. The benefits are overwhelming: from increased productivity and loyalty to a more sustainable and harmonious business through the generations.

References

Dumas, C., Blodgett, M. Articulating Values to Inform Decision Making: Lessons from Family Firms Around the World. International Journal of Value-Based Management 12, 209–221 (1999).

Eisenberg, R. (2019, January 22). How to Plan for a Successful Succession. Retrieved from https://familybusiness.org/content/How-to-plan-for-a-successful-succession

Kuffel, H. (2019, July 24). How Is Legacy Planning Different From Estate Planning? Retrieved from https://smartasset.com/estate-planning/legacy-planning

LaVigne, K., & J.d. (2019, April 23). Holistic Legacy Planning: It's About More Than the Money. Retrieved from www.kiplinger.com

Muson, H., & Muson, H. (n.d.).

Prince, R. A. (2016, January 5). The Importance of Family Values in The Family Businesses. Retrieved from https://www.forbes.com/sites/russalanprince/2016/01/05/the-importance-of-family-values-in-the-family-businesses/#34a6c23f1023

Rogoff, Edward G. and Zachary, Ramona K., The Evolving Family/Entrepreneurship Business Relationship (Special Issue) (2003). Journal of Business Venturing, Vol. 18, Issue 5, p. 559-687 2003.

Sharma, P., Chrisman, J. J., & Chua, J. H. (2003). Predictors of satisfaction with the succession process in family firms. Journal of Business Venturing, 18(5), 667–687. doi: 10.1016/s0883-9026(03)00015-6

Scott, D. (2017, November 15). Three Common Misconceptions About Legacy Planning. Retrieved from https://www.forbes.com/sites/danielscott1/2017/11/15/three-common-misconceptions-about-legacy-planning/#3760786b281e

Wang, Y., & Shi, H. X. (2020). Particularistic and system trust in family businesses: The role of family influence. Journal of Small Business Management, 1–35. doi: 10.1111/jsbm.12533