The Entrepreneur's Profit Model: A Diagnostic Tool

Entrepreneurs usually understand that profit is important. But many are less consciously aware of the actual model by which they will (or will not) make money in their ventures. Many have a gut feel, but no formal model. This article describes a simple yet powerful diagnostic tool that consultants, students, investors and entrepreneurs can apply to new venture concepts to determine the attractiveness of the underlying profit model, and then improve upon it.

Components of the Profit Model

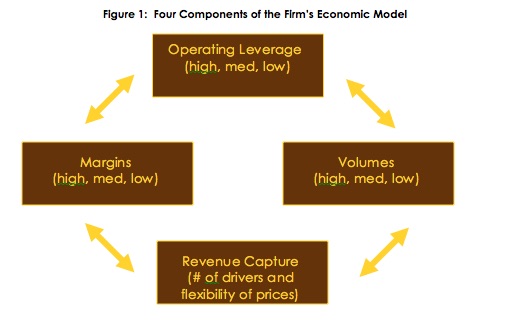

Our model has four basic components: margins, volumes, operating leverage and revenue drivers. They are illustrated in the diagram below. Let us briefly examine each component.

Figure 1: Four Elements of the Firm’s Economic Model

We start with margins, or the contribution that each product or service makes towards profitability once the direct cost of that service or product has been covered. Margins are the price a customer pays minus the cost to the business of providing that product or service. What affects a product or service’s margins? Margins can be manipulated by finding more efficient ways of making or providing the product/service, or by adding value to a product/service so that the entrepreneur can raise the prices.

Second, volumes capture the activity levels in the business. Volumes deal with the number of transactions the business has over a period of time (e.g., daily, monthly) and the average value or quantity sold per transaction. A comparison of two types of restaurants will make this clear. A fast food restaurant operates on the premise that it charges low prices for relatively standardized goods produced en masse, and will have high volumes or a large number of transactions per day. Conversely, an exotic high-end restaurant will emphasize customized service, a relaxed, luxurious atmosphere and a talented chef. This high-end restaurant will expect to have much lower volumes than a fast food establishment, but will expect the value of each transaction (and hence the margins) to be much higher. Expected volumes affect such decisions as staffing needs, quantities to keep in inventory, and space requirements. Once these decisions are made, they limit how much activity the business can handle.

The third variable that determines the firm’s profit model is termed operating leverage, or the firm’s cost structure. The basic question here is the extent to which the overall cost structure consists predominately of fixed costs or variable costs. So operating leverage is the ratio of total fixed cost to total variable costs at a given level of volume (say break-even volume). A firm with high fixed costs has high operating leverage, where one having costs that are predominantly variable has low operating leverage. Variable costs are those that change in direct proportion to the core activity of the firm. For a factory, the core activity is units produced; for a web-based business, it might be transaction on the website; for a law firm, it might be billable hours. Examples include direct labor hours or cost of materials. Fixed costs are those that remain the same regardless of activity levels within the firm -- such as rent, salaries, depreciation, and insurance. We can think of them as the firm’s overhead. When starting a venture, having more fixed costs means the entrepreneur has increased risk. Volumes or margins must be high to offset high fixed costs. These costs are incurred and have to be paid, regardless of whether or not sales are being generated. With high fixed costs, it takes longer to reach breakeven, but once there, the firm makes a more profit. Thus, profits are more volatile when the firm has high operating leverage. Stated differently, slight changes in revenue lead to much more significant changes in profitability.

The final question concerns how the firm captures revenue. This includes how many revenue drivers the firm has, and the degree of flexibility within these drivers. Revenue drivers refer to all of the major ways in which the company makes money. Consider an automobile dealership. Money might be generated from car sales, auto leases, repairs, parts and warranties. In this instance, the dealer has five revenue drivers. Revenue drivers include everything that generates revenue, and so can be thought of as the firm’s major product and service lines. Hence, a restaurant with 150 items on the menu, or a hardware store with thousands of individual products, organizes these items into a more manageable set of revenue drivers, such as entrees versus alcoholic beverages at the restaurant, or hand tools versus lumber at the hardware store.

The Impact of Revenue Drivers

Both revenue and profit will likely vary across the different revenue drivers. Some drivers may be what are called "loss leaders." Some may exist simply to provide a full line or enable the positioning of the firm. One revenue driver may exist to support sales of other drivers. For example, our dealership may make relatively little money on the cars, while earning most of its profits from parts and service. Similarly, a copier company finds margins are steadily decreasing on their line of copiers as customers begin to view the product as a commodity. However, most of those who buy a copier also buy a service contract, where margins are quite high. So the entrepreneur prices his copiers low (perhaps at break-even), but sells more service contracts as a result, and on balance makes a good profit.

Also important for revenue capture is the flexibility of how these drivers are priced. Pricing can be fixed or flexible. It is fixed when the firm offers its goods at a standard, published price, such as the menu in a restaurant, without variation or negotiation. With flexible pricing, the entrepreneur is able to modify prices depending on when the product is purchased, who is purchasing it, how much they are purchasing, or what other products they are purchasing (e.g., product bundling). Hence, a restaurant might have a fixed price menu, but when it does catering, it negotiates prices. Flexible pricing can give the entrepreneur more creative leeway to capitalize on market opportunities, optimize capacity utilization and maximize overall revenue. This is why, if a passenger on an airplane flight asked any five fellow passengers what price they paid for their ticket, he or she will likely get five different numbers.

Connecting the Dots to Diagnose Venture Attractiveness

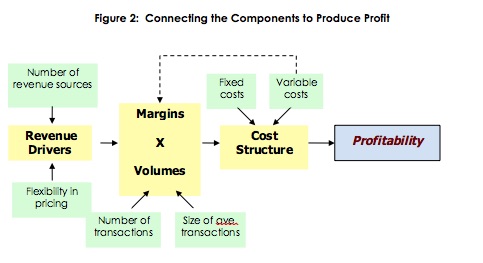

The profit model concerns how these four variables, when combined, affect the firm’s ability to make money. The interactions among the variables are illustrated in Figure 2. It centers on margins and volumes. Consider a business that sells furniture and has high (over 100%), medium (40-60%), or low (10-15% or less) margins. Assume the same business has high (sells 60 pieces of furniture a day, on average), medium (sells 20 pieces of furniture a day), or low (sells 4 pieces of furniture a day). A global chain like IKEA makes money with high volumes and medium margins, while a local specialty retailer selling high-end furniture is succeeding based on low volumes but high margins. If the entrepreneur has a high volume but low margin business, a decent profit might be earned. The same would be the case for a low volume but high margin business. Things look even better with high margins or volumes combined with medium volumes or margins. While it rarely happens, the company that can achieve both high volumes and high margins is going to make huge profits. Apple Computer and the iPhone would be an example. Alternatively, the truly unsustainable business is the one with low volumes and margins.

Figure 2: Connecting the Components to Produce Profit

Next we factor in the cost structure of the venture. If the business has a lot of fixed costs, again either the margins or the volumes need to be relatively high, and the other should be at least medium. The goal is to spread the fixed costs over as many transactions as possible. A company like Tesla that makes electric cars, which has very high fixed expenses (e.g., salaries, R&D, a manufacturing plant, dealerships and marketing) has relatively high prices, but struggles to turn a profit because it costs a lot to make each car (variable costs) and volumes are relatively low.

Finally, we factor in the way the firm captures revenue. A business that is experiencing a profit problem in terms of its combination of margins, volumes and fixed costs is in even worse share if it only has a single revenue driver. The entrepreneur may be able to improve the picture by adding revenue drivers, or moving to negotiated prices. Consider a person who owns a small submarine sandwich business located near a university. Fixed costs are relative high due to rent, a manager’s salary, insurance and marketing costs. Margins are low as prices are kept down by fairly intense competition. Having a good location is producing decent volumes, but these volumes fall off dramatically during the summer and Christmas holiday period, when students are gone. This combination has the business barely making any profit. Turning this situation around might involve adding a new revenue driver. For example, a catering service might offset seasonal fluctuations in sales volume, while also offering higher margins.

Once all four variables are assessed, the entrepreneur can evaluate the relative attractiveness of the venture. For instance, a model with low volumes, low margins, high operating leverage, and a single revenue driver at a fixed price is going to lose money. A much more attractive economic model is one where margins are high, volumes are medium to high, operating leverage is medium and the firm has multiple revenue drivers with considerable price flexibility.

To test this framework, we surveyed 2,000 retailers in Upstate New York. The findings suggested five dominant profit models were relied upon by these firms -- that is, a number of different avenues that can help a business attain profitability in a given industry. These models were:

- High Value Model – In this model there were few transactions, or low volumes, but the value per transaction was relatively large as were the margins.

- High Turnover Model – This model was characterized by high volumes but low margins.

- Medium Fixed Model – The revenue sources and pricing was fixed with medium margins, volumes and fixed costs.

- Medium Flexible Model – In this model the revenue sources were very flexible with medium margins, volumes and fixed costs.

- Middle of the Road Model – This model was characterized by middle-range values for margins, volumes, revenue driver flexibility and fixed costs.

Different models would emerge in other industries. As profitability is the core aim of a business, it makes sense to spend some time considering which strategies a firm should adopt to get there.

Trying to Improve the Attractiveness of Your Model

The framework we are proposing serves as a diagnostic tool. With it, entrepreneurs can identify where there is room for manipulation so as to improve the economic attractiveness of the venture. The ability to develop high earning ventures that have real growth potential can be facilitated in a number of ways (see Table 1). Key facilitators include creativity and imagination, financial insight, resource leveraging and bootstrapping, use of low cost technologies, and strategic focus. Let us apply these facilitators to the variables in the profit model:

Margins

Increasing margins is a first priority in most ventures, important in its own right, but in many cases easier to achieve than manipulations of the other three variables. From a pricing vantage point, entrepreneurs need to be willing to price more on the basis of how much value they are providing to different types of customers, rather than based on estimated unit costs. They must go beyond just focusing on the customers that are the most obvious (and often more price sensitive), or assuming all customers are equally price sensitive. Further, the ability to charge more is tied to differentiation, or creating meaningful difference from the offerings of competitors. Creative pricing can also improve the picture. Examples include:

- a low base price and sell add-ons at high margin

- pricing differently at low or high peak times

- unlimited use of product or service for a flat fee

- base price and then variable charges once a threshold is reached

- different prices for different market segments

- loyalty schemes for past or heavy users

- price differences for users who can only buy/use at certain periods

- prices tied to customer characteristics, such as size of their family, house or car

- bundled pricing for multiple items

- cash and quantity discounts

- trade-in/trade-up schemes

The other side of the equation is finding ways to reduce the variable costs of the goods being sold. The possibilities here are tied to a) finding ways to produce the product or service in a less labor-intensive manner by using more efficient labor practices, incorporating more or better equipment, or automating tasks, and b) reducing costs of materials or goods purchased. Entrepreneurs must bring a philosophy of efficiency to every aspect of what they are doing---developing an intimate feel for the flow of how every task is done and how each task contributes to a well-run operation. A number of areas can be focused upon that can significantly bring down costs, from breaking down and systematizing tasks and establishing standard procedures to eliminating clutter and having the right things in the right places. Although buying industrial grade equipment may be too expensive in the early days of the business, a leveraging strategy can be employed to borrow, share, barter to obtain, or rent the equipment and possibly the technologies belonging to other parties. With procurement, economies can come from shopping around, purchasing in larger lot sizes, buying in tandem with other small businesses, and buying on consignment.

Volumes

The ability to increase the volume of sales or transactions in the business requires creativity both in defining target markets and in expanding capacity. The core market being served is often too small or being served by too many other firms. The entrepreneur must look for additional niches where, with a little value added, new sales can be accomplished. For instance, an entrepreneur opens a paint ball facility where customers compete on teams to defeat other teams by shooting them with dye-filled gelatin capsules. The target market is teenagers, but this limits volume on the days when school is in session. The entrepreneur recognizes that companies might utilize the facility on school days as an employee team-building exercise, and adapts operations and marketing approaches to attract them. Another entrepreneur has a cake-making business that concentrates on specialty cakes for weddings and formal events. She starts looking for additional niches, and finds sales can be considerable augmented by specializing in church socials, and a monthly program addressing employee birthdays at companies.

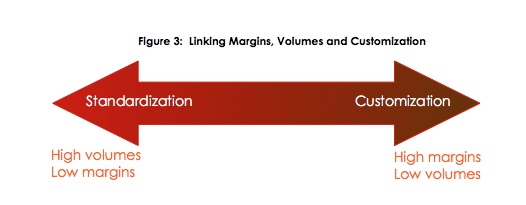

A major issue affecting volumes is the extent to which entrepreneurs customize their offering to individual clients. Customization requires time and money and so significantly limits capacity. Anxious to attract and please customers, some business owners will add customized features or provide tailored services such as personal delivery without charging for these things (and when charging a low price to begin with). Figure 3 illustrates the basic relationship between degrees of customization and the margin-volume relationship. It is a relationship that entrepreneurs do not want to find themselves on the wrong side of.

Figure 3: Linking Margins, Volumes and Customization

Capacity can also be expanded by augmenting one’s facilities and equipment. Again, leveraging comes into play, where the entrepreneur seeks to share the facilities or equipment of others. Using another company’s machines during down time, sharing space in someone’s warehouse, borrowing a truck after hours, or outsourcing parts of the work can help the entrepreneur produce more without making big investments.

Operating Leverage (Cost Structure)

Reducing fixed costs can be the most difficult variable to address in the profit model. Most start up entrepreneurs are operating on a very lean basis to begin with, and simply cannot afford to spend a lot on rent, the purchase of capital equipment, salaries or marketing. So, there is not much to cut. Again, however, using the assets of others and outsourcing can serve as methods for reducing fixed costs. Similarly, clever guerrilla tactics can bring down marketing costs. Taking advantage of the increasing availability of low-cost technology is yet another way to avoid or lessen overhead costs.

Revenue Capture

Finally, the entrepreneur is continually looking for different ways to capture revenue, both in terms of how the customer is charged, and the different products and services being provided. Making a premium version of one’s service available, charging a subscription rate rather than pay-as-you-go, offering an extended warranty, or adding a product that complements or augments the entrepreneur’s basic product are a few examples.

Table 1. Key Questions Surrounding the Profit Model

Revenue Drivers

- Do I have a wide variety of revenue drivers or only a few?

- Are there other creative ways to capture revenue?

- Can I make some of my prices negotiable or subject to a quote?

- How often do I change my prices? Is it frequently (hourly, daily, weekly or biweekly)? Moderately frequently (monthly, bimonthly)? Or rarely (semiannually, annually or longer)?

- Might I use product or service bundling, different prices for different market segments, pricing based on customer loyalty, or other creative tactics?

Margins

- Are my margins relatively low (e.g., a grocery store) or high (e.g., a jewelry store)?

- Does my business add significant value to the products or services, enhancing the brand?

- Might I be able to make higher margins by selling to different kinds of customers?

- Could I offer customized services that would allow me to charge significantly higher prices?

- Are there ways to cut unit costs by buying in larger quantities, purchasing from lower cost suppliers, using more equipment or incorporating technology into my business processes?

Volumes

- Do I have significant capacity constraints?

- Am I a relatively high, medium or low-volume business?

- Do I offer highly customized services which decreases the volumes I can process, or are my goods and services very standardized, allowing me to increase my business’s volumes?

- How saturated is the overall market?

- What quantity of items am I selling relative to the competition over a specific time period?

- What is the average value of a transaction in my business and how does that fare against competition? Are there ways to get people to spend more per visit?

Operating Leverage

- What proportion of my costs are fixed versus variable?

- Are there any key fixed costs I can reduce, such as by operating from home, in a smaller facility, or in a borrowed space?

- Can I eliminate salaries and just pay people on an hourly basis?

- Could I do more to outsource of parts of my business so as to convert certain fixed costs into variable costs?

In closing, the reality is that all ventures, regardless of how cool their product or service, have to make money. Critical flaws often exist in one or more components of the underlying profit model, particularly when the four components are combined. The key is continual experimentation with the profit model framework presented here. With insight, ongoing learning, imagination, engagement in different resource leveraging approaches, clever use of new technologies and a guerilla mindset, the entrepreneur can produce much more and achieve greater efficiencies, while realizing larger returns on their efforts.

Professor of Entrepreneurship and Social Innovation / Keogh School of Global Affairs / University of Notre Dame

View Profile