By Kristin Brandl, Ram Mudambi and Vittoria Giada Scalera

Abstract

Over the second half of the 20th century, Indian pharmaceutical firms were nudged by government policies to focus on import substitution. To this end, they were encouraged to produce generic variants of foreign MNEs’ branded drugs. In response, MNE strategies in India became strongly focused on intellectual property (IP) protection, most typically implemented through the avoidance of collaboration with domestic firms. Hence, domestic firms in the industry developed mostly independently from the influence of foreign firms but with a strong guidance from governmental policies. Everything changed when India ratified the provisions of Trade Related Aspects of Intellectual Property Rights (TRIPS) in 1995 and committed to full implementation by 2005. A significant number of domestic firms recognized that the returns to imitative, re-engineering oriented innovation would inexorably decline under the new regime. These firms implemented aggressive new strategies aimed at generating world- class product innovation. In this paper, we document the rise of these Indian domestic innovation champions.

Introduction

In most cases, emerging market firms catch-up processes are significantly influenced by knowledge spillovers from foreign multinational enterprises (MNEs). In India, this “MNE-partnership model” has been documented in the well-known (and successful) IT sector (Lorenzen and Mudambi, 2013), as well as in less familiar examples like the auto parts industry (Kumaraswamy et al., 2012). However, the Indian pharmaceutical industry evolved differently and as we document here, it is at odds with the traditional development trajectory. This development has arisen through the often uncoordinated co-evolution of government policies and MNE strategies. High skilled human capital, governmental support and global linkages based on personal relationships were the recipe for the fast development of the Indian pharmaceutical industry, activating a virtuous circle of knowledge creation that connects India with the rest of the world. This case study establishes that innovation catch-up, the most sophisticated component of the catch-up process, need not necessarily be sparked by knowledge flows from foreign entities.

India is changing and so is the Indian pharmaceutical industry. Waves of products developed, produced and exported by ever-growing Indian pharmaceutical firms such as Dr. Reddy’s or Ranbaxy have started to penetrate the global pharmaceutical market. Anticipating the current “make-in-India” campaign, an increasing amount of innovation is indeed made-in-India. But as we will document below, Indian pharmaceutical firms were not always innovation-driven. In fact, for most of the second half of the 20th century, Indian pharmaceutical firms were nudged by government policies to focus on import substitution based on imitation. To this end, they were encouraged to develop capabilities in process technologies aimed at producing generic variants of the branded drugs developed by foreign MNEs.

In response, MNE strategies in India began to place a strong emphasis on intellectual property (IP) protection. In particular, these foreign firms stressed the prevention of knowledge spillovers to domestic firms. This meant that MNE subsidiaries in India were given very little freedom to pursue local innovation activities and were also discouraged from collaborating with local partners. Hence, domestic firms in the industry developed mostly independently from the influence of foreign firms but with strong guidance from governmental policies.

The Indian Pharmaceutical Industry

The Indian pharmaceutical industry is one of the oldest industries in the country, with the first locally owned modern firms established in the early 1900s. However, by the middle of the twentieth century, the industry was dominated by subsidiaries of foreign multinationals that predominantly operated large sales operations with little or no R&D. With independence in 1947, the government took steps to encourage the domestic sector (including setting up public sector firms). In spite of strenuous efforts, for many decades Indian firms were confined to the lower-unit-value bulk drugs segment. They struggled to innovate and develop new drugs, the requisite for entering and competing in global markets. Local knowledge-intensive activities like drug discovery and process R&D were conspicuous by their absence.

The Indian pharmaceutical industry developed in several stages influenced by government policies implemented to address diverse objectives: improving the country’s healthcare sector and complying with global intellectual property protection regulations to secure access to the industry’s global innovation system. After India’s independence in 1947, the country’s economy was strongly influenced by a widespread system of regulations, most importantly the Industrial Licensing Act of 1951, which restricted the expansion of businesses and gave a dominant role to state-owned institutions. Due to the economic conditions after independence and the virtual disappearance of a local Indian firms, foreign MNE subsidiaries and imports dominated the country’s domestic pharmaceutical market. However, with heavy government investments in the domestic science and engineering education system and in the scientific infrastructure, times began to change. The domestic scientific workforce began to expand and world-class research institutions, such as the Council of Scientific and Industrial Research (CSIR) arose. Despite these positive changes, India’s performance in terms of generating influential innovations was poor, as the individual components – the educational institutions, the government labs and the private sector – did not work together as system.

Only after the adoption of the 1970 Patent Act, were domestic firms incentivized in their efforts to innovate. This Act encouraged firms to patent drug manufacturing processes, but not the complete products. As a consequence, domestic firms were motivated to develop generic equivalents of extant drugs with new production processes and methods through reverse engineering. However, the local IP protection standards were considered sub-par by foreign MNEs, so they undertook virtually no local knowledge creation and innovation. Only after India signed on to the World Trade Organization (WTO) in 1995, and set in motion the process of ratifying the Trade Related Aspects of Intellectual Property Rights (TRIPS), did a substantial transformation occur. With the ratification, the Indian pharmaceutical industry underwent a fundamental change, from a rather loosely regulated industry to one governed by a rigorous product patent regime. Based on its development status, the WTO granted India a 10-year transition period (ending in 2005) to reach full compliance with the requirements of TRIPS. The Indian government amended the 1970 Patent Act and began a process of implementing rigorous legal protection for product patents and related IP rights, with the objective of reaching the standards of the developed world by 2005.

Aside from encouraging increased domestic innovative activities in the market and the support of new locally based R&D, the new regulations provided more protection for foreign MNEs’ IP. Consequently these firms renewed their emphasis on the Indian pharmaceutical market. They brought new and improved products and knowledge into the market, increasing awareness among domestic firms of the opportunities in new drug developments. This awareness caused many Indian firms to set up research facilities and laboratories as part of drug discovery and innovation programs.

The Rise of Domestic Innovation Champions

We are able to document foreign firms’ R&D in India (mainly for local adaptation) beginning in 1980). Our study is based on the output of patents granted by the U.S. Patent and Trademark Office (USPTO), generally accepted to be a crucial and internationally accepted metric of global innovative excellence. For instance, between 1980 and 1990, subsidiaries of foreign MNEs produced 121 U.S. patents in their India-based R&D operations, virtually all of which claimed minor extensions of previous patents granted to their parent firms. During this decade, domestic Indian firms produced no U.S. patents at all. Indian firms’ world-class innovation outputs in terms of U.S. patents only begin to appear in the last years of the 1990s, but today they far outpace foreign MNE firms in terms of the scale of R&D outputs emanating from local operations.

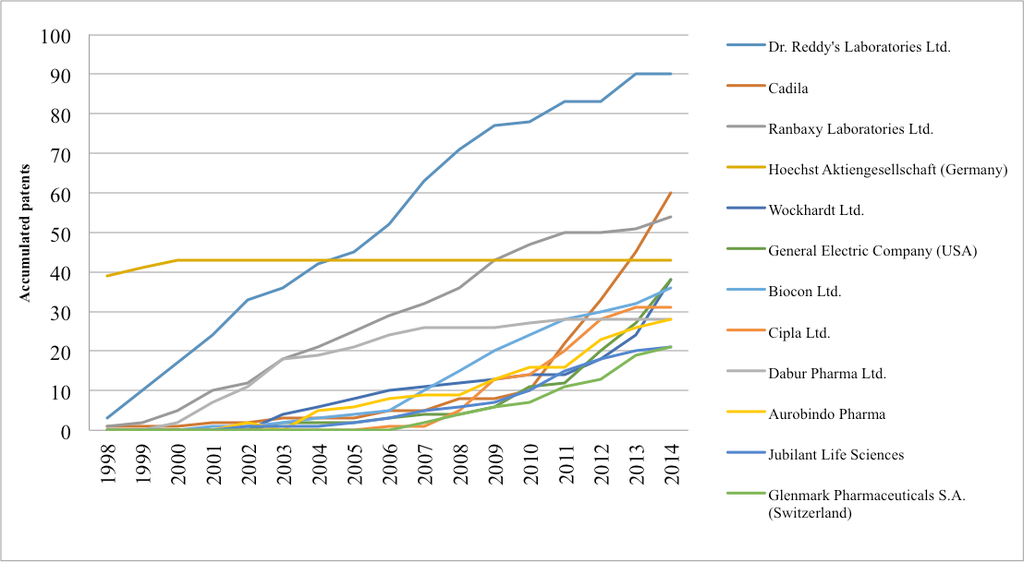

A closer look into the innovative trajectory of the Indian pharmaceutical market demonstrates quite clearly that the innovative profile of the industry changed dramatically with its accession to the global innovation system following its entry into the WTO and acceptance of the provisions of TRIPS. The government led by example in terms of moving toward world-class innovation outputs and this shows up in the steep increase in the production of U.S. patents by government labs. For instance, the CSIR produced 540 U.S. patents between 1994 and 2015, while only producing 27 between its founding in 1950 and 1993. Our analysis reveals several Indian firms now show world-class innovative capabilities, and the genesis of all of these outputs is in the period immediately following the ratification of TRIPS in 1994 (see figure below).

Dr. Reddy’s is by far the most successful Indian pharmaceutical firm in terms of globally recognized innovation output. It filed its first U.S. patent application in 1996 for a diabetes drug and was approved in December 1997. Panacea Biotec Ltd. was also granted its first U.S. patent in 1997, but subsequently several other local firms have overtaken it in terms of innovation performance. The supports the argument that the Indian government put policies in place that effectively supported firms’ innovation activities, enabling national companies to also compete successfully in international markets. The graph below shows a significant increase in innovation output from 2002 onwards and another spurt starting from 2006, which we attribute to the end of the 10-year TRIPS transition period in 2005. In addition to Dr. Reddy’s Laboratories Ltd., many other Indian pharmaceutical companies have ramped up their innovation output and expanded their activities worldwide, turning into globally dispersed multinational enterprises. These include firms like Biocon Ltd., Cadila, Ranbaxy and Wockhardt.

The recent performance of Cadila is particularly notable and it has produced an impressive upward trajectory in patent output over the last five years to amass the second largest patent stock among Indian pharmaceutical companies. Ranbaxy was acquired by Daiichi Sankyo in 2008 and subsequently returned to local ownership when the Japanese firm sold a controlling stake to Sun Pharmaceuticals in April 2014. In recent years, Sun has become an active innovator in its own right – it obtained its first U.S. patent in 2008 and accumulated a total of 23 by the end of 2014. The combination of Sun and Ranbaxy has created the largest Indian pharmaceutical company and the fifth largest specialty generics company in the world. Our data indicates that the combined firm may soon surpass Dr. Reddy’s as India’s pharmaceutical innovation powerhouse.

The ratification of TRIPS and the associated stringency in IP protection has also had a salutary effect on the innovation capabilities of foreign MNEs in the Indian pharmaceutical industry. However, our data shows that their patent output from their Indian labs is far smaller than that of Indian pharmaceutical companies (see the Figure). Among the top twelve innovating firms in the Indian pharmaceutical industry based on U.S. patent stocks, only three are MNEs – Hoechst, General Electric and Glenmark. Our study of trajectories indicates that the growth rate of patent output of the locally based firms is significantly higher than that of the MNE subsidiaries. This suggests that within a very short time, the dominance of local firms on the patent output scoreboard is likely to increase even further. For instance, after the German MNE Hoechst Aktiengesellschaft was acquired by Rhône-Poulenc in 1999, it appears to have shut down innovation operations at its Indian subsidiary. The firm is now known as Sanofi India and has no local patent output.

This analysis indicates that the government’s outward-oriented strategy of acceding to the WTO and accepting the provisions of TRIPS have had a significant beneficial impact on the industry and especially on local firms. Indian firms have recognized the importance of innovation and R&D and that reverse engineering is not the way forward for global expansions and growth. The data demonstrates quite clearly that several Indian firms are well on their way to becoming major players in the pharmaceutical industry’s global innovation system.

Summary

Firms learn from firms. Smaller firms and less advanced emerging market firms are able to capitalize on the knowledge of firms based in advanced market economies, be it on a national or international level. Firms tend to cluster in and around certain locations, source knowledge externally and collaborate internationally even with competitors. This is especially true with regard to innovative capabilities and R&D. Thus, emerging firms and locations have much to gain from foreign direct investment and MNE subsidiaries located in their midst, through what have been called “spillover processes” (Mudambi, 2008).

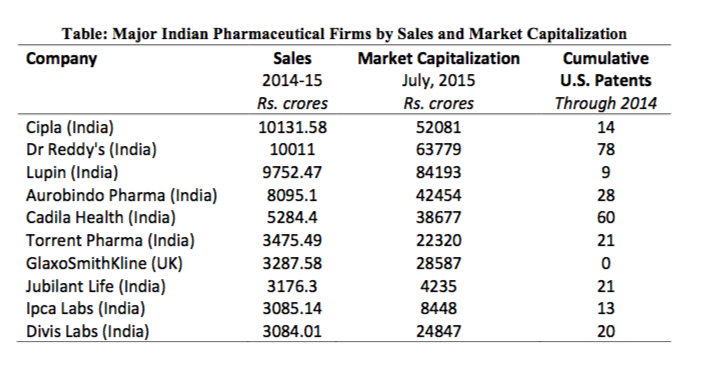

However, the Indian pharmaceutical industry has not followed this traditional path of catch-up through collaborating and working within the global value chains of advanced economy firms. Its uncommon path provides an excellent counter-example, illustrating that emerging economy catch up is not a “one size fits all” model. With relatively direct collaboration with or spillovers from the foreign firms in the market, Indian pharmaceutical firms have developed superior R&D and innovation skills, leveraging the local scientific knowledge and nudged along by outward oriented government policies. Indeed the list of top ten pharmaceutical firms in India by sales contains only one MNE subsidiary – GlaxoSmithKline (see Table).

The knowledge-intensive firms like Dr. Reddy’s and Cadila are beginning to capitalize on their innovative outputs by establishing strong market positions and reaping the consequent financial rewards (Table). The growth of a few big Indian pharmaceutical firms reveals the change undergone within the national pharmaceutical industry, emphasizing the strong link between innovation and competitiveness – especially in high tech sectors.

This case study throws up important questions for research, policy and corporate strategy. Are these costs associated with eschewing collaboration with foreign MNEs? How generalizable is this experience to other high technology industries and other emerging market contexts? How does this model of government intervention compare with one that is more market driven?

It is clear that MNEs in the pharmaceutical industry are repositories of an enormous store of knowledge. However, industry insiders view IP as a key source of competitive advantage. Hence these MNEs jealously guard their IP and are reluctant to collaboration with partners in situations and contexts where they fear knowledge leakage. This is especially true when they do not expect to gain much in terms of reciprocal knowledge flows. Thus, while we expect that the costs of non-collaboration with knowledge-rich MNEs are probably fairly low in the pharmaceutical industry, this result may not generalize to industries that have a more open approach to innovation.

However, we believe that our findings are generalizable to other emerging market contexts. For instance, in an ongoing related study, we find that foreign MNEs are NOT the major source of knowledge inflows into the Chinese pharmaceutical industry. Similarly, in the wind turbine industry, we find that emerging economy firms have been able to source knowledge by acquiring component manufacturers in advance economies (Awate et al., 2012; 2015).

The pharmaceutical industry has been described as “high science” industry, one where basic research is the foundation upon which commercial innovation occurs (Cockburn and Henderson, 2001). The knowledge threshold for entry into such industries is extremely high and innovation processes rely on very highly educated scientists. Hence the government has key role to play in funding tertiary educational institutions and research labs. In contrast, industries like information technology and metal fabrication are less reliant on basic research, so that market players like venture capitalists and larger firms assume a more important role.

References

Awate, S., Larsen, M.M. and Mudambi, R. 2012. EMNE catch-up strategies in the wind turbine industry: is there a trade-off between output and innovation capabilities? Global Strategy Journal, 2(3): 205-223.

Awate, S., Larsen, M.M. and Mudambi, R. 2015. Accessing vs. sourcing knowledge: a comparative study of R&D internationalization between emerging and advanced economy firms. Journal of International Business Studies, 46(1): 63-86.

Cockburn, I. and Henderson, R. 2001. Publicly funded science and the productivity of the pharmaceutical industry. Pp. 1-34 in Lerner, J., Jaffer, A. and Stern, S. (eds), Innovation policy and the economy, Vol.1. Cambridge MA, The MIT Press.

Lorenzen, M. and Mudambi, R. 2013. Clusters, connectivity and catch-up: Bollywood and Bangalore in the global economy. Journal of Economic Geography, 13(3): 501-534.

Kumaraswamy, A., Mudambi, R., Saranga, H. and Tripathy, A. 2012. Catch-up strategies in the Indian auto components industry: domestic firms’ responses to market liberalization. Journal of International Business Studies, 43(4): 368-395.

Mudambi, R. 2008. Location, control and innovation in knowledge intensive industries. Journal of Economic Geography, 8(5): 699-725.