Family Businesses Can Learn From the Battling Brothers of Oasis

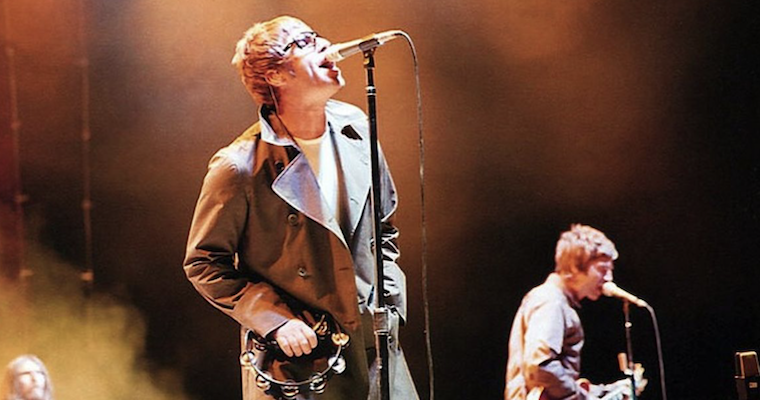

Over the past month the entertainment world has been buzzing about the reunion of Oasis, one of the major bands of the '90s. This concerns brothers Noel and Liam Gallagher, who were able to rise to the role of leading figures in global music during the '90s but also fought to the point of abandoning a valuable brand after just 18 years of work. Today, 15 years after their breakup, they announced that they will be reunited onstage in 2025 for a tour, and tickets sold out in just a few hours. Their songs have once again become some of the most listened to worldwide on Spotify. From a business perspective, how much has it cost these two brothers not to get along and to continue working separately for the last 15 years?

The situation is classic: Rivalries among siblings are very common, as they naturally compete for parents' attention, affection, and approval. After all, even the Bible notes that Cain and Abel, the first two brothers in "history," did not have a good relationship. Siblings can also be very different, with varying resources, skills, inclinations, and personalities. While these differences can be precious and celebrated in some settings, they also can lead to miscommunication and misunderstandings. Tensions can grow over time when issues such as caring for elderly parents and, especially, inheritance come into play.

Sibling conflict is also a classic theme in family business, just as in the case of OASIS. It is inevitable that two brothers who, beyond their blood relation, share ownership and/or management of one or more businesses can develop conflicting dynamics concerning business issues. At the same time, conflicts that arise in the family setting, particularly when siblings themselves start their families, can easily transfer to the business setting. Therefore, family firms should think about how to avoid certain dynamics to safeguard not only family harmony but also the economic value of the business, in the interest of all stakeholders.

I believe there are five guidelines to follow.

- CLEARLY DEFINE ROLES. When the roles of siblings in the business are not clearly defined, tensions can arise. One brother may feel excluded from important decisions or may perceive that his contribution is not recognized. A lack of clarity about who makes strategic decisions or who holds operational responsibility can create conflicts. It is essential to clearly define each person's rights and responsibilities based on their role in governance (Owner? Director? Manager?) and in the organization (Leader? Manager? In what function?), to reduce the likelihood of sparks flying.

- PLACE MERIT AT THE CENTER. A family business is not a family. In a family, merit is not necessarily a value; parents take care of their children based on different needs and equality criteria. In a business, these criteria do not work, because what matters must be merit. Those who work harder and better should receive more in terms of salary. If a less deserving sibling holds positions (and receives remuneration) similar to those of a more deserving one, it will inevitably lead to conflicts. This applies even more so to the spouses of the siblings: If they enter the business and climb the ladder without merit, a break is around the corner. It's better to clarify entry, career advancement, and remuneration criteria for relatives (and possibly in-laws) in a family agreement.

- COMMUNICATE OPENLY AND REGULARLY. Siblings should be able to openly discuss their concerns and visions for the company so that differences result in better decisions rather than conflicts. In this sense, it can be crucial to create a family council that formally allows siblings (and other relatives) to fully express themselves in an orderly way and reach shared and objective decisions. The family council is tasked with drafting the family agreement and possibly revising it over time. As the Latin proverb said, “verba volant, scripta manent.” Translated: "(spoken) words fly away, written ones remain."

- CAREFULLY PLAN SUCCESSION. This applies to both leadership and ownership. Regarding leadership, poor decision-making (or indecision!) about who will lead the company can trigger rivalries among the siblings, especially if they all aspire to it. Parents may struggle to choose between their children, even when one is more suitable than the others, so planning the leadership transition in advance reduces the likelihood that rivalries become unmanageable. In terms of ownership, it must be noted that issues related to inheritance are a source of tension in every family, especially in an entrepreneurial family. Again, it’s wise to plan in advance how to transfer family wealth to one’s children, including the business, to prevent family fights and even legal issues.

- INVOLVE ADVISORS. Both preventing conflicts and resolving them often requires external intervention. Advisors can help implement the points raised in the previous sections without the process itself becoming a source of tension. As outsiders to the family, advisors have greater emotional detachment from family dynamics, allowing even the siblings themselves to make business decisions with higher objectivity.

EDITOR'S NOTE: This article originally appeared in Italian on familybusinessforum.net and has been translated.

Photo Credit: Wikimedia Commons

Professor / FABULA (FAmily BUsiness LAb) / Cattaneo University - LIUC

View Profile