Being Coachable Can Pay Off for Founders – Up to a Point

Entrepreneurs often benefit from the advice and support of great mentors and investors who want to work with them. One powerful way entrepreneurs can attract great mentors and investors is to improve their coachability.

In a study published in Entrepreneurship Theory and Practice, we explore the role of entrepreneurial coachability in attracting mentors and investors to devote their time and money to an entrepreneur. We define coachability as “the degree to which an entrepreneur seeks, carefully considers, and integrates feedback to improve his or her venture’s performance” (Ciuchta, Letwin, Stevenson, McMahon, & Huvaj, 2018). Given the benefits of coachability for entrepreneurs, both practitioners and scholars have been keenly interested in exploring which factors, in the words of BlueTree Allied Angels founder Catherine Mott, help an entrepreneur become “the kind of person who takes advice” (Gardella, 2010). To our surprise, however, prior academic studies had not developed a formal definition of entrepreneurial coachability. So in the first step of our research, we consulted with experts in the field and looked at how other literatures such as athletics (Smith, Schultz, Smoll, & Ptacek, 1995) defined the term to derive our own definition.

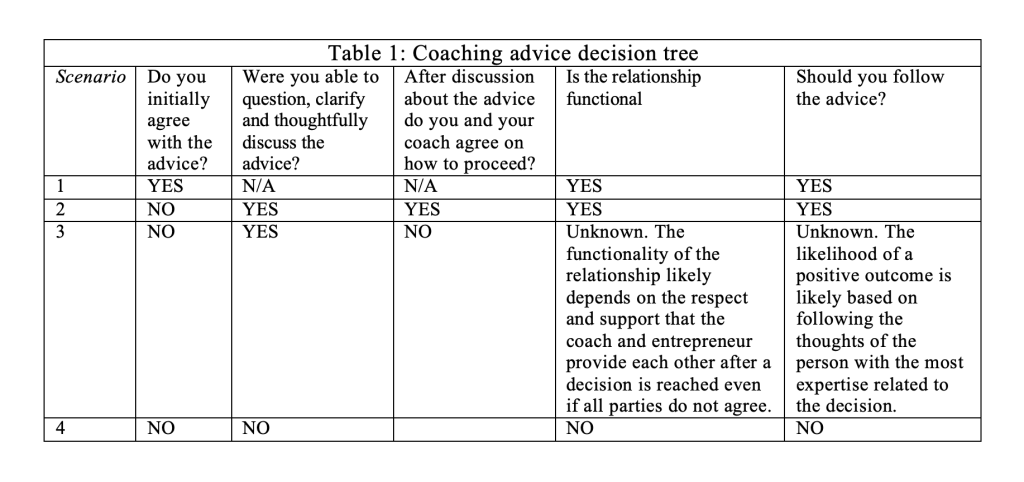

This article shares some theoretical and practical insights about coachability that we learned through our research. A key takeaway: While investors and support organizations such as accelerators prefer coachable entrepreneurs, being coachable doesn’t necessarily make your firm more successful. We also provide guidelines for both entrepreneurs and coaches to navigate their relationship, including a decision tool (Figure 1) that entrepreneurs can use when assessing whether or not to follow a coach’s advice.

Why entrepreneurial coachability matters and why it may not

Being coachable helps entrepreneurs in many different ways. In a recent interview, Marjorie Radlo-Zandi, an angel investor at Launchpad Venture group, noted, “The CEO/founder must be coachable,” and that coachability was one the things she needed to see before making an investment (Gallagher, 2019). Further, David Berkus, who manages five early-stage funds and has made 200 early-stage investments, writes, “As an early-stage investor, the first test for me is whether ‘my’ entrepreneur is flexible...and whether s/he, no matter what age or experience, is coachable” (Berkus, 2017). These investor comments are backed up by academic research that shows investors prefer more coachable entrepreneurs (Mitteness, Sudek, & Baucus, 2010), particularly investors with prior coaching experience (Ciuchta et al., 2018). Additionally, evidence suggests that investors are more likely to invest in entrepreneurs who demonstrate coachability in addition to competence (Svetek, 2022). This preference for coachable entrepreneurs is not limited to potential investors. Entrepreneurial support organizations such as accelerators are more likely to select coachable startups (Beyhan, Akçomak, & Cetindamar, 2021).

Clearly, increasing access to investment and other resources is crucial for entrepreneurial success, so coachability can be a valuable skill. It does not, however, tell us if being coachable actually leads to positive venture outcomes. This question is a bit trickier and seems to have a much more nuanced answer. In entrepreneurial support organizations (e.g. accelerators), which often have a large coaching component, findings regarding the value of being coachable are mixed. Some work has suggested that being coachable is positively related to important outcomes, such as the innovativeness of products and the performance of the firm (Kuratko, Neubert, & Marvel, 2021; Marvel, Wolfe, & Kuratko, 2020). Other findings, however, demonstrate that coachability has no impact on firm performance (Bryan, Tilcsik, & Zhu, 2017). The authors point out that context matters: Ignoring a coach’s advice because you know more about the topic is very different than doing it out of stubbornness.

Thus, while coachability may help entrepreneurs attract resources and entrepreneurial support, the business value of coachability likely depends on who is giving the coaching, who is receiving the coaching and how both parties perceive the idea of coachability. Below we provide some practical guidelines for both entrepreneurs and coaches regarding the effective use of coachability in this dynamic relationship.

Coachability Do’s and Don’ts

Coachability is NOT simple agreeableness

For entrepreneurs: DON’T try to pretend you are coachable. Coaches want authenticity and will know if you are just trying to ingratiate yourself (Sanchez-Ruiz, Wood, & Long-Ruboyianes, 2021). DON’T blindly follow a coach’s advice. You have often thought about your business for many years and are domain experts (Suleimenov, 2014). DO seek and carefully consider advice from coaches. You shouldn’t necessarily follow their suggestions lockstep, but you should give their advice full consideration. Further, DO feel free to question, clarify, and thoughtfully discuss a coach’s advice before implementing it.

For coaches: DON’T assume someone is coachable just because they nod their head and agree with you. Give them real challenges and see how they respond. DO value and take advantage of the knowledge that founders bring to the table. DO encourage them to seek your guidance but also to critically consider your feedback and question it if needed.

Coachability is a two-way street

For entrepreneurs: DON’T just focus on resources or knowledge that the coach brings to the table. DO think about what it will be like to have this person in your corner (or not) for years to come. DO get to know a potential coach to ensure that his or her personality, work style and long-term goals are a good fit. In today’s funding landscape, entrepreneurs have more and more funding avenues (Stevenson, Kuratko & Eutsler, 2018) and so you can be coachable without having to subject yourself to the tyrannical demands of a particular coach (Stevenson, McMahon, Letwin, & Ciuchta, 2022).

For coaches: DON’T adopt a “my way or the highway” attitude. DO recognize that founders are also evaluating you and that you can learn from them. But at the same time, if you have the choice, DO only coach people you want to be around.

No two streets are the same

For founders and coaches: A coaching relationship is a function of the coach, the entrepreneur and the unique situation that brings them together. As such, DON’T assume every founder/coach dynamic is the same. DO appreciate that each potential founder/coach relationship will be different. What works with one founder/coach may not work with another. DO use early encounters to explore the relationship. It will be much easier to walk away early on, especially before resources have been exchanged. But DON’T give up. Some challenges will emerge. DO try to work through them. You are both better off when the relationship is open and honest. Lastly, DO everything you can to select for and build a valuable and meaningful founder/coach relationship: it can be both monetarily and emotionally enriching. Enjoy it!

When to listen to a coach and when not to

As discussed above, being coachable is far different than blindly following advice, and is based on a dynamic two-way relationship that is unique to the coach, the entrepreneur, and their individual and collective situations. Therefore, determining “good” or “bad” advice ex ante without knowledge of the specific parties and specific situations may not be possible. However, we can provide simple common-sense guidance based on the coach/entrepreneur interaction as to when the relationship is likely to be more functional and therefore lead to more positive outcomes. We depict this advice as a decision tree for founders in Table 1. It presents a series of questions the entrepreneur should address regarding both the content of the advice as well as how the advice was provided.

Let’s look at two situations in which the entrepreneur did not initially agree with the advice provided. The first one involves the familiar story of Mark Zuckerberg turning down Yahoo!’s $1 billion offer for Facebook (Fass, 2013). According to early angel investor Peter Thiel, he and VC Jim Breyer (both Facebook board members) thought Zuckerberg should take the offer, but Zuckerberg told them that he had no interest in selling. They cautioned Zuckerberg to consider how much money he would make and what he might do with it. Zuckerberg felt like Yahoo! did not have a clear vision of the future and therefore could not value what did not yet exist. Zuckerberg did have a vision. Ultimately, despite some concern, Thiel bought into Zuckerberg’s vision and they declined the offer. This is a good example of Scenario 2 in our decision tree, in which the coach and the entrepreneur respected and supported each other and had a meaningful conversation that lead to a decision based on the entrepreneur’s knowledge of what Facebook was and his vision of what it could be.

The successful outcome can be juxtaposed with the failure of Salorix, another social network platform that had cutting-edge technology and was the acquisition target of a large tech company, in this case Google.[1] Similar to the Facebook example, the founder, Santanu Bhattacharya, was not as interested in the offer as his investors. Unlike the Facebook example, however, Santanu and his investors were not able to reach an agreement about the offer. The investors then stopped providing funding, ultimately leading to the failure of the company. This is also a good example of Scenario 3, but where the relationship was non-functional. In this case the parties did not continue to support each other and could not have a meaningful conversation to determine the best path forward for the company.

Conclusion

From a review of academic work and practitioner experience, it is clear we are just beginning to learn about entrepreneurial coachability and its impact on venture outcomes. It’s clear that investors and other resource providers generally prefer working with more coachable entrepreneurs. But it’s less clear whether being more coachable translates into better venture success, short or long-term. Researchers may want to look at that question. And from a practical standpoint, it is clear that although every situation will be different, both entrepreneurs and coaches can adopt a coachability perspective to examine their relationship and what steps might be possible to make it better.

Explore the Research

Ciuchta, M. P., Letwin, C., Stevenson, R., McMahon, S., & Huvaj, M. N. (2018). Betting on the Coachable Entrepreneur: Signaling and Social Exchange in Entrepreneurial Pitches. Entrepreneurship Theory and Practice, 42(6), 860–885.

References

Berkus, D. 2017. Do you think you are flexible and coachable?, Berkonomics.

Beyhan, B., Akçomak, S., & Cetindamar, D. 2021. The startup selection process in accelerators: Qualitative evidence from Turkey. Entrepreneurship Research Journal.

Bryan, K. A., Tilcsik, A., & Zhu, B. 2017. Which entrepreneurs are coachable and why? American Economic Review, 107(5): 312-316.

Ciuchta, M. P., Letwin, C., Stevenson, R., McMahon, S., & Huvaj, M. N. 2018. Betting on the coachable entrepreneur: signaling and social exchange in entrepreneurial pitches. Entrepreneurship theory and practice, 42(6): 860-885.

Fass, A. (2013, March 12). Peter Thiel Talks About the Day Mark Zuckerberg Turned Down Yahoo's $1 Billion.

Gallagher, T. 2019. “5 Things I Need To See Before Making An Angel Investment”, with Marjorie Radlo-Zandi of Launchpad Venture Group, Medium. https://medium.com/authority-magazine/5-things-i-need-to-see-before-making-an-angel-investment-with-marjorie-radlo-zandi-of-launchpad-cc32a9d9b416: Accessed 11/28/2022.

Gardella, A. 2010. What Exactly Is a “Coachable” Entrepreneur? , New York Times. http://boss.blogs.nytimes.com/2010/10/12/what-exactly-is-a-coachable-entrepreneur/?_php=true&_type=blogs&_r=0: Accessed 9/2/2014.

Kuratko, D. F., Neubert, E., & Marvel, M. R. 2021. Insights on the mentorship and coachability of entrepreneurs. Business Horizons, 64(2): 199-209.

Marvel, M. R., Wolfe, M. T., & Kuratko, D. F. 2020. Escaping the knowledge corridor: How founder human capital and founder coachability impacts product innovation in new ventures. Journal of Business Venturing, 35(6): 106060.

Mitteness, C. R., Sudek, R., & Baucus, D. A. 2010. Entrepreneurs as authentic transformational leaders: critical behaviors for gaining angel capital. Frontiers of Entrepreneurship Research, 30(5): available at: http/digitalknowledge.babson.edu/fer/vol30/iss35/33.

Sanchez-Ruiz, P., Wood, M. S., & Long-Ruboyianes, A. 2021. Persuasive or polarizing? The influence of entrepreneurs' use of ingratiation rhetoric on investor funding decisions. Journal of Business Venturing, 36(4): 106120.

Smith, R. E., Schultz, R. W., Smoll, F. L., & Ptacek, J. T. 1995. Development and validation of a multidimensional measure of sport-specific psychological skills: The Athletic Coping Skills Inventory-28. Journal of Sport & Exercise Psychology, 17: 379-398.Stevenson, R. Kuratko, D.F. & Eutsler, J. 2019. Unleashing main street entrepreneurship: Crowdfunding, venture capital, and the democratization of new venture investments. Small Business Economics, 52: 375-395.

Stevenson, R., McMahon, S. R., Letwin, C., & Ciuchta, M. P. 2022. Entrepreneur fund-seeking: toward a theory of funding fit in the era of equity crowdfunding. Small Business Economics, 58(4): 2061-2086.

Suleimenov, A. 2014. You idiot. You’ve been listening to me for 20 minutes, and I’ve been working on this for 5 years! , No Water, No Moon. Accessesd 12/6/2014.

Svetek, M. 2022. The Role of Entrepreneurs’ Perceived Competence and Cooperativeness in Early-Stage Financing. Entrepreneurship Theory and Practice: 10422587221127000.

[1] https://www.failory.com/cemetery/salorix

Associate Professor / Marketing, Entrepreneurship & Innovation / University of Massachusetts Lowell

View Profile